As the E-Commerce sector is growing tremendously, it has already invited online scammers and frauds to carry their heinous activities and hurt businesses. In the newly secured payment system, a customer receives a new ‘chip’ credit card that will need a pin to make the payment for the product. The introduction of a new payment system has been proved successful until yet, and it looks like it will be used in the entire world to curb out online hacking and bring transparency without any threat.

There are many ways hackers can reach you and complete their imbecile works. The following are the three keys by which merchants can fight fraud.

Need for Good Customer Base

Every merchant wishes to have a trustworthy customer base that can understand the efforts and needs of him to bring best e-commerce experience and to make the payment system completely safe and reliable. Hence, the merchant feels sandwiched as it has to develop a flawless fraud protection strategy while offering a hassle-free payment system.

Instead of wasting time on picking through every transaction, the merchant should start mapping their customers through their order history, spending patterns etc. and make a list that can help them to find out fraudulent accounts floating in their systems.

Using Fraud Protection Tools to Churn Out Bad Ones Help the Business Significantly

There are many tools available for merchants to identify both good transactions and fraudulent ones –

- Scanning and Identifying Stolen or Suspected Cards After you enter your debit or credit card information, fraud prevention ways or software scans more than 4 billion cards transaction globally and finds the right information about your registered details. It will prevent fraudulent transaction without further examination

- IP Piercing and Device Fingerprinting Cleverly relating individuals to their past purchases on different portals or from different devices help in identifying fraud users.

Using Fraud prevention software develops an on-going relationship between a merchant and a customer as it brings excellent user-experience for buyers to complete their shopping and build trust in merchant’s services and business abilities.

Tap Tokenization

Often online hackers stream credit or debit card information of customers from the systems owned by merchants. The data that merchants save for later use to prepare their business strategy, and offer discounts to their loyal customers, are being misused by online hackers.

In Tokenization, a merchant doesn’t need to store sensitive information of its customers on the system, nor it has to transmit the system through his networks. Instead, the data is safe on the payment provider’s secure and PCI compliant infrastructure. If a merchant is desired to store its customer’s credit and debit card information, then PCI demands complex certification and support set up for business to secure the private information of the customers.

Embrace ‘Braintree’ – A Superior Payment Tool by PayPal

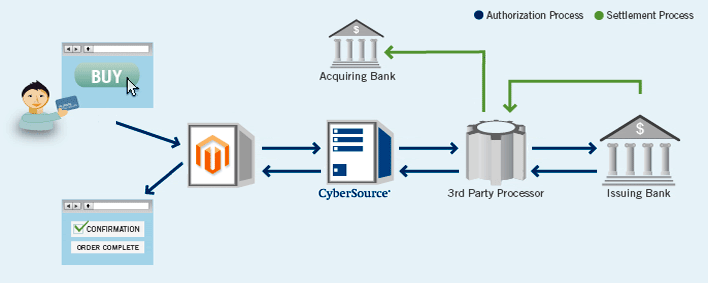

By accepting a merchant account, payment gateway, recurring billing, and sophisticated fraud management tools, ‘Braintree’ accepts debit and credit to help online and mobile business. If you have an e-commerce portal, then ‘Braintree’ connects its payment gateway account with the Magento store for secure payment transactions.