We always try to find out the secrets behind the successful business. Online business dealers always seek trustworthy and secure transactions, especially for the customers to have a hassle-free checkout. It is a must to know about the gateway which you are going to use while making any payment in Magento 2.

Magento 2 supports a wide range of payment gateways that offer merchant services in all parts of the world. It can be a complicated decision to choose the best payment gateway from dozens of gateways available these days for Magento 2.

Let’s understand the Pros of Magento 2

The one who is new to ecommerce finds it difficult to select which payment gateway is to accept.

Many of the newcomers even get confused while making a final decision of payment gateway online. Before going for the final selection of gateway, it is a must for the users to study the gateways first so that they come to know about all the technicalities and the positive and negative outcomes of it.

With regards to overseeing the web stores, there are numerous things to consider from deciding your intended interest group to setting up your items and beginning to offer. It is very vital to build up a reliable relationship with your clients.

The best way to do that is by guaranteeing a protected payment method. Many plebeians make online payments in a hurry, so waiting for long and inconvenient can make them have a bad thought about that gateway or site.

Deciding and making the mind to use the best gateway for your transactions can make you have fast and quick payment.

Before going into the different payment gateways, let’s have a quick reminder- how these payment gateways work?

These payment gateways are the ways of making monetary transactions safe. Its main purpose is to protect customers against identity theft by encrypting their card, whether credit or debit details. It acts as a bridge between the merchant and the payment processor.

If your middleman that is your payment gateway does not work properly, customers will show less interest in buying things from your store. These payment gateways must have four basic things include pricing, convenience, capabilities and security.

Magento 2 payment gateway is a mechanism that allows you to integrate your stores with payment service providers. As a result, you can create and handle transactions based on order details.

Magento Security Facts – How ‘Magento’ Protects from ‘E-Commerce’ Fraud

Give a choice to customers

Before going into anything, make sure you are providing several gateways so that it can be easy for customers to choose the gateway of their choice. But make sure you keep one thing in mind that many gateways or payment processing systems have some monthly charges to be paid.

Why Magento 2 for payment gateway?

Magento is the leading e-commerce content management system. It is providing easy integration with so many payment gateways options. The most vital thing is that it provides the customers with good service of quick payment without any inconvenience. The other crucial aspect is it can be used anytime and with ease to the users because of its simplicity and acceptance of international payments in a secure way.

Aspects to remember when determining the best payment gateway Magento 2

1.Select a gateway that fits development on the Magento Platform:

Magento community is designed for businesses in e-commerce that are just starting up the organization for new biz. For small or grown e-commerce platforms, the Magento enterprise is best suited. Most Magento gateways are not expanding to the level of an enterprise. Choosing a payment processor that supports both community and enterprise editions of Magento will be advisable.

2. Enhanced consumer service

Everything is customers. When selecting an appropriate payment gateway, you must consider them. Your portal of choice will make checkout simple for them. If possible, the details of payment should be auto-filled to relieve the strain on checkout for your client.

3. Safe Interface for Transaction

During the checkout process, you need to protect your e-commerce store from fraud (both criminal fraud and illegal charges). Because people typically gave up buying online because they didn’t feel their payment would be safe. A secure payment gateway to protect your customers against fraud and your business from losing money is what can resort to the issue.

4. Global backing

Your business, today, maybe small, you might still sell to local consumers. But that is not going to stay that way forever. It will grow, and one day you’ll need a payment gateway that can cater to your clients in other countries. It is strongly advised that you select an e-commerce platform that facilitates more parts of the world, currencies, card networks, and methods of payment that are popular outside your site.

5. Functional requisite

Magento 2 has already developed default payment gateways with it. Others need to be integrated so it can function as expected. This should be kept in mind when choosing your gateway to payment.

Insight To Various Payment Gateways With Magento 2

There are several gateways available for making a secure payment with Magento 2. With Magento 2 various payment integrations are also available out of the box. But some of the very secure and trusted gateways that are highly recommended with Magento 2 are Paypal, Amazon.com, Worldpay, Stripe and Braintree.

-

PAYPAL

It is the most widely used payment gateway method due to its simplicity and security it offers to the clients. Another factor of PayPal is, it is the most professional online payment Service Company and the convenience it provides to the customers while making their online payments or transactions.

Features

– This method of secure payment support (Parallel, Delayed and Instant Chained) adaptive payments. Apart from this, it even supports multiple sellers.

– Admin gets commission-based sellers. More the sellers will be there more commission he will get.

– The most important feature of this is it’s free of cost as it doesn’t require any paid set up or no monthly fee is charged.

– It is available in almost 200 countries, so it is rightly said that it’s highly accessible due to its wide range of availability.

– Customizes invoices can be created and send with this method.

– Very less time is consumed to make the payments. With a single click and fewer formalities, the transaction is done.

Positive aspects

– Its wide availability and accessibility build trust among the other users. So due to its credibility, more users rely on this for their online payments.

– Both debit and credit cards are accepted for payments.

– Not very difficult to set up can be done in a minute or two.

– Less time-driven and easy for people of all ages to use it.

– The refund can be partial or full.

– Providing ease of connectivity and flexibility in learning about customers.

– You can use it for more than just paying through your PayPal account.

Negative Aspects

– Due to its easy setup, it’s a target for many fraudulent sellers.

– If your account gets lock so unlocking your account takes a long time.

– Not all extensions are available yet online.

– Charge high for your business transactions.

– Bad customer support

– It can freeze your account without any prior information.

-

AMAZON.COM

It is a flexible payment gateway that allows a good experience to customers for their online shopping. It even offers two business services Amazon Simple Pay and Checkout by Amazon. With this gateway, you can send and receive money using its own Application Program Interface.

This method enables the customers to spend more time while the selection of products through the catalogue and very less time to check out with payment. This is a good way of making the customers engagement more, and this increases more clientele.

Features

– It provides with good customer protection system.

– It even comes up with a fraud detection system.

– It verifies the customers with a good and advanced login system.

– Customers choose a payment and shipping method in the widget.

– There is no upfront cost to enable this payment gateway on your site.

– Making ease for the customers all the transaction is completed on your site only.

– It even allows you to control the whole shopping experience.

Positive aspects

– Numerous merchant tools, such as payment marks and buttons, logos and marketing guides.

– The fees associated with this payment gateway are 2.9 percent + 0.30 USD per authorization.

– Customers with a good and advanced login system.

– Merchants get the best rates with Amazon.

– It even helps to realistically set merchant expectations

Negative Aspects

– Account suspension without informing.

– Amazon Payments does not operate on a contract.

-

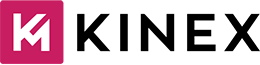

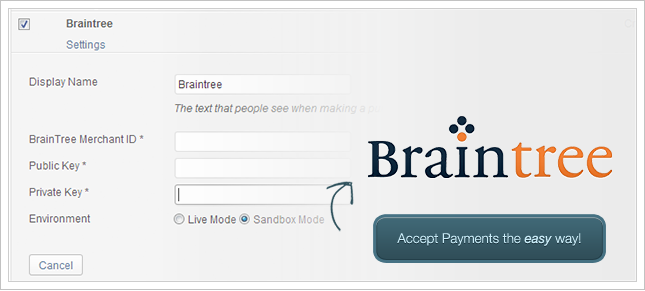

BRAINTREE

It is another best payment gateway that comes with global fraud protection and local payment proficiency in a single integration. It even comes up with multiple outlines and currency settlement also. It is also a widely used gateway as it comes up with smooth payment checkouts for both applications and websites.

It features over 130 currencies and used in 44 countries as a whole.

Features

– It comes with no monthly fee.

– It is flexible to work for small businesses and global ones as well.

– It provides basic fraud protection security, PayPal integration build in and secure data storage.

– Customers can even save their information for further use.

– They can even alter their information by adding new or deleting the existing one.

Positive aspects

– Security at its best with well-designed everything

– Pay only for what you have used

– Supports global payment method

Negative Aspects

– No return fees on partial refunds

-

STRIPE

It is a payment gateway that was made with the thought of making the business transactions online easy. Its services are available in 25 countries with acceptance over 100 types of currency. Apart from their present gateways, it accepts all major credit cards as well as Bitcoin, Alipay, Apple Pay, and Android Pay but still working on it to bring more for the ease of customers.

Features

– It comes with many exciting offers and provides trial periods also.

– It provides instant transactions through debit cards.

– It even allows you to assign permission levels and create terms.

– It even comes with unlimited options for plan types.

Positive aspects

– It provides so many developmental opportunities.

– You can do so many things with stripe only if you are tech-savvy. This can be one major benefit for you.

Negative Aspects

– It does not provide any 3D secure services.

– It charges you according to the change in your functionalities. So try not to change it so much.

-

WORLDPAY

This ensures the best services with no time to check out and no hassles to the customers. With its smooth and good functioning, it serves brilliantly nationwide. The best part of the payment gateway is that it provides no third party processors, all the transactions are in-house, so it is a direct processor.

Features

– It allows merchant accounts.

– It even comes up with ATM services for the customers.

– It even allows good and on-time mobile payments.

Positive aspects

– It accepts cross border payments and multiple currencies.

– It provides savings for big businesses by decreasing the rates when there is an increase in volumes.

– It provides customers with 3D security by making their information safe and secure for all the transactions.

Negative Aspects

– No doubt, they promise a fast turnaround but all in vain. They take a long time or too much delay in large transfers. Sometimes it may take four weeks to access your money.

– Prices vary for different businesses in different industries.

– Carefully audit the greater part of their set terms and conditions to completely comprehend the genuine expenses included.

Magento 2 Featured Themes Facts – The Finest Magento 2 Themes

-

MONERIS

It is a payment gateway used for both medium-large businesses and small businesses that are looking to expand quickly. It even offers an array of innovative services and payment solutions that keep up with industry trends. It provides both mobile debit and credit processing.

Features

– It provides a wide range of services for merchants with both debit and credit payments.

– Its technology even facilitates electronic business- to- business payments.

– This payment platform is very secure and reliable.

– It provides customers with 24\7 support.

Positive aspects

– This gateway is able to provide additional services such as inventory and sales tracking capabilities in partnership with different companies like BMO, RBC and Sage Accounting.

– It holds seasonal businesses for up to 6 months.

Negative aspects

– Billing problems and technical issues.

– Many reports of unexpected and excessive cancellation fees, hidden processing/monthly fees, and broken promises of refunds and rebates.

CONCLUSION

While choosing the payment gateway, make sure it meets your requirements for the long term as well as for short term objectives. Here we talked about 5 gateways only, but there are more payment gateways available which you can access. But before going into it, you must have knowledge of that particular gateway in detail about its benefits and negative impacts. This can help you and your customers in a good way without leaving a bad impression on them.